Market Leasing Assumptions are your projections of what will happen in the future. We already know, according to our rent roll, that Willa's Mediline is going to be in the space through 4/30/2018. But what happens after that? We don't know, but we'll make some assumptions. So! Click on the box under Market Leasing until a new box pops up.

Starting at the top.

Category: This is the name you're going to give the MLA. It's good to give it a descriptive name so you can remember what it is you're modeling. I'm going to name this MLA "Office- $2.80"

Press Tab. (To switch through menu items, press tab. To switch through table items, press enter. It takes awhile to get used to it. Clicking on the box you want to work in works as well.)

Lease Status: Leave it as Speculative.

Press Tab.

Renewal Probability

Definition: The likelihood that the tenant is going to renew their lease. I typically enter this as 75%.This is saying, there's a 75% likelihood that when Willa's Mediline's lease expires, they're going to renew.It's possible to enter the number straight into the box, but this can create a headache down the road. It's best to have all your assumptions as detail. So, with the white box next to Renewal Probability selected, either press the "Detail..." button down below OR Alt+E.

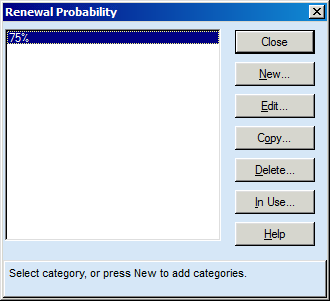

A box that says "Renewal Probability" will pop up. It will be blank (unlike mine, that's pictured below).

Click the "New..." button OR Alt+N. A new box will pop up looking like:

Name it "75%" in the Category Box.

Leave the "Based On" box alone. It should say "None"

Click on the first white box next to % to Renew.

Type 75%.

Press Alt+E to extend 75% into every year. (OR press the extend button)

Detail (what you're in right now) gives you the ability to have different assumptions for different years. For renewal, it's rare you would assume a different % for different years.

Your table should now look like:

Press the OK button. (OR tab then enter.)

Now you have a renewal probability assumption!

Press the Close button. (OR tab then enter.)

Renewal Probability is entered. Let's move onto Market Rent.

Market Rent

Definition: The price a tenant will pay at the beginning of their lease. We once again want to enter the rate in the detail. With the Market Rent white box selected, press the Detail... button (Or Alt+E) Alt+E does so many wonderful things.

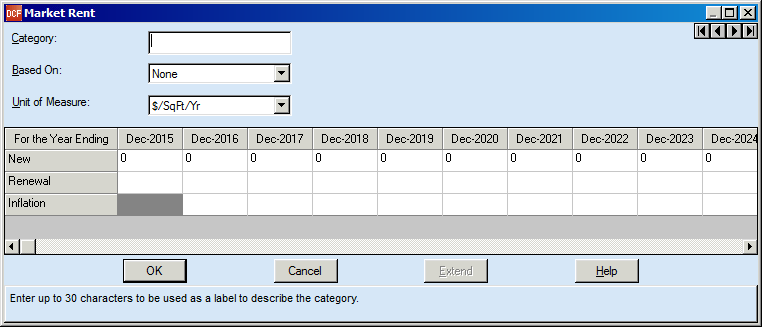

Then Press "New..." (Or Alt+N) This box should pop up:

The market rent for this building is $2.80 per square foot per month. for the Category name, type in the category box: $2.80/SF/MO.

Based on: None

Unit of Measure: $/SqFt/Mo (It can be super duper easy to forget to change this box from psf per year to psf per month and this will lead to some wonky/incorrect cash flows) so make sure you change it to $/SqFt/Mo. Sometimes you'll be given market rates on a per year basis and sometimes on a per month basis. It all depends on the market and what's standard in the market.

Sometimes I'll get information such as: "Market rent should be $2.80 in 2015, $3.00 in 2016, $3.20 in 2017, and $3.30 in 2018 with 3% rent growth after that." I would override the inflation with 0% and input those numbers in the boxes. It would look like this:

But this time we just want the market inflation to control how the rent grows. Enter $2.80 in the first New box and press Alt+E or Extend... so every box has $2.80 in it. Do not enter anything in the renewal line. This will make it default to the New line. Do not enter anything in the inflation line. This will make it default to the Market Rent inflation we put in the Inflation Tab. It should look like this when you're done.

Press Ok. Press Close. You should be back to the main MLA page.

Let's move onto Months Vacant.

Months Vacant

Definition: The amount of down time between when the old lease expires and the new lease begins. Depending on how aggressive we're being, usually between 6-12 months. Let's assume 9 months of vacancy.

What you're entering in is GROSS Months Vacant. There are both Gross and Net months Vacant. The difference revolves around the Renewal Probability.

Given a Renewal Probability of 75%, 75% of the time, the tenant will be assumed to renew and there is NO downtime. There are no months vacant in the space. 25% of the time (100%-Renewal Probability) there will be 9 months of vacancy. Argus takes these two assumptions, and calculates the NET Months Vacant.

Given 75% Renewal Probability and 9 months vacant:

Net Months Vacant = 2.25 months (75% * 0 mos. + 25% * 9 mos. = 2.25 mos.)

So. Once again to enter the 9 mos. vacant, we're going to enter it in the detail. Seriously, totally worth it to go into the detail.

This is exactly what I pressed on the keyboard starting at the MLA screen with Months Vacant selected:

Alt+E

Alt+N

9 mos.

Tab

Tab

9

Alt+E

Tab

Enter

Tab

Enter

You should be back in the MLA's with 9 mos. entered in the months vacant.

Let's just leave Tenant Improvements, Leasing Commissions, Rent Abatements and Security Deposit Alone for right now. We'll swing around and fill in those assumptions in a new post.

Let's jump to Rent Changes.

Rent Changes

It currently says "No" and we're going to change that.

Definition: Rent changes affects the rent your speculative tenant will pay once the lease begins. If you do not do anything with the Rent Changes, every lease that begins in 2015 with these MLA's will pay $2.80 for the entire term. Unless you're working with the government or failing retail, that isn't realistic.

Typically I model either 3% annual increases or $0.50/per SF/yr rent bumps.

With the Rent Changes white box selected, press Alt+E (Detail...) Press Alt+E again. Press Alt+N. You should get to the screen shown below:

Name the category 3% Annual Inc.

Go to the date column and Enter "1" This means the start of the lease/Month 1

Press Enter.

Enter "100" in the Amount Box

Press Enter.

Under the Units Column click on the box and scroll through the options until you find % of Market

Press Enter.

You should be on the second line. Enter "13" This is the number of months into the term. We want there to be an increase in rent the month after the last month of the year, i.e. the 13th month.

Press Enter.

Enter "3"

Press Enter.

Scroll through the Units until you find "% Inc, Annual"

Press Enter.

This means that every year, the rent will grow by 3%.

It should look like this when you're done:

Press Ok then press close then Ok. You should be back at the Market Leasing Assumptions page.

The last thing we'll go over in this post: Term Lengths

You can't enter detail into Term Lengths. We're going to assume a Term of 5 Years. Enter 5 in the box.

Your MLA's should now look like this:

Oops, except I had already entered in TI's/Leasing Commissions/Rent Abatements. Ignore those! Press ok! You should be back on the Rent Roll page. Hooftah. I feel like we covered a lot.

Here is the investors contact Email details,_ lfdsloans@lemeridianfds.com Or Whatsapp +1 989-394-3740 that helped me with loan of 90,000.00 Euros to startup my business and I'm very grateful,It was really hard on me here trying to make a way as a single mother things hasn't be easy with me but with the help of Le_Meridian put smile on my face as i watch my business growing stronger and expanding as well.I know you may surprise why me putting things like this here but i really have to express my gratitude so anyone seeking for financial help or going through hardship with there business or want to startup business project can see to this and have hope of getting out of the hardship..Thank You.

ReplyDelete